Change, Darwin’s Thesis, and Business Value and Transition

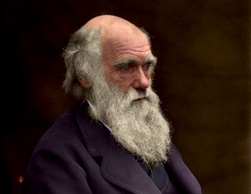

Why is a picture of Charles Darwin[1] relevant to a discussion of business value and transition?

Answer: Based on 50 years of business value and transition consulting experience I believe:

- we live in a watershed economic, business, and business value and transition environment.

- today, as never before, Charles Darwin’s thesis of natural selection needs to be understood and considered by every business owner.

What is Charles Darwin’s thesis of natural selection?

Initially, Darwin did not use the term Survival of the fittest. Instead, British economist Herbert Spencer used that phrase after reading Darwin’s 1859 book On the Origin of Species. It caught on, and Darwin used the term in a subsequent edition of his book.

Survival of the fittest is an umbrella phrase that masks and leads many to misinterpret Darwin’s messaging. If one takes the time to read and consider other quotes attributed to Darwin[2] it becomes clear that a high level Darwin’s thesis can be stated to be:

‘those who implement change to their advantage more quickly than others are those who, through collaboration, best identify and adapt to change.’

Is ongoing economic and business change impacting business value and transition?

The answer must be ‘yes’ given the smorgasbord of ongoing inter-related economic and business-related segment changes that include:

- Globallization.

- Potential de-globalization if President Trump has his way.

- Central bank policies – particularly after 2008.

- Developed and developing country government debt, government intervention, government policies, and government intervention.

- Technological advances.

- Business consolidation.

- Financial markets heavily influenced by algorithmic trading.

- Climate change.

- World population growth and societal disruption.

- Incomplete, sensationalized, and in some cases what appears to be poorly researched news.

These and other things will continue to impact both the value and transition of most if not all large and small publicly and privately-owned businesses to varying positive and negative degrees.

Concerning that melded ongoing change:

- Some of these changes and related changes are more predictable than others.

- The pace of change is likely to escalate in some of the cited segments.

- All businesses will be influenced in varying degrees and for better or worse by ongoing changes.

- For some companies these changes collectively may lead to business value enhancement, for others business value deterioration – and hence to greater or less business transition success.

How does Darwin’s thesis play into a discussion of business value and transition?

Business value growth and in turn successful business transition are both influenced – I believe in an ever-escalating way – by the degree to which business owners accept and act upon Darwin’s thesis.

It is crucial that all business owners hear this messaging, and that each decide whether they agree it makes sense. Moreover, this messaging is particularly important for owners of family businesses. That is because there is a greater proclivity for family business owners to compromise from arm’s length principles where their emotional intelligence plays too large a part in their business decision making.

I believe that all business owners should consider Darwin’s thesis and apply it to their specific circumstances. Private company business owners, irrespective of whether the business is family-owned, need to consider their ability to adapt quickly to changing business conditions and prospects having regard to their collective capabilities and the current and prospective financial position of their company.

Private company business owners should consider now – and on an ongoing basis as they experience continuing change in our increasingly competitive business environment:

- whether developments and advances outside their control are impacting the near- and long-term risks and going-concern viability of their business.

- whether the long-term going-concern viability of their business is at risk as a result of its current financial position, growth prospects, and competitive prospects going forward.

- whether the size and prospective size of their business are such that it will be able to compete effectively in the near- and long-term. This where larger companies in many cases seem increasingly likely to be favored in the contexts of – among other things – both supply and demand chain metrics as a result of ongoing globalization and technology advances and the costs and cost savings related to both of those things.

- whether as a result of conclusions reached in respect of business viability and likely future competitiveness, whether their business should be offered for sale now, or be prepared for sale at some point in the next, say, two – five years.

- whether current employees need to be replaced with persons better equipped to face current and prospective competitive challenges.

- whether ongoing technological advances may have a material favorable or adverse effect on their business in the contexts of both required future capital investment, and the timing of that investment.

Finally, in family businesses, it is becoming ever more critical to consider whether employed family members should retain their current positions, or should assume jobs that better suit their skill sets. Any family business owner that objectively makes such assessments and acts on them will bring a smile to Charles Darwin’s face, wherever he now is.

[1] Charles Darwin’s (1809 – 1882) book On the Origin of Species by Means of Natural Selection, or the Preservation of Favoured Races in the Struggle for Life was first published in 1859.

[2] For example, Darwin is quoted as saying: “It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one most adaptable to change, that lives within the means available and works co-operatively against common threats.” ”The world will not be inherited by the strongest, it will be inherited by those most able to change.” “It is not the biggest, the brightest or the best that will survive, but those who adapt the quickest.” “In the long history of humankind (and animal kind, too) those who learned to collaborate and improvise most effectively have prevailed.”

Tags: advisors, board of directors, business, business consolidation, Business Owner, business owners, business transition, Business Value, business value and transition, business value growth, central bank pollicies, Charles Darwin, Climate Change, companies, company, Darwin’s thesis, de-globalization, Family Business, family business owners, financial markets, Globalization, going concern viability, Government Debt, government intervention, government policies, government regulation, natural selection, ownership transition, population growth, privately-owned, publicly-traded, Recession, Regulation, societal disruption, survival of the fittest, Technological Advances

RSS - Posts

RSS - Posts