by Ian R. Campbell | August 9, 2019 | Technology

Articles, books, and presentations periodically come to our attention we think business owners and their advisors ought to find valuable. This presentation is one of those. Review time is estimated to be about 20 minutes. Thinking time may be much longer.

Have you read AI Super-Powers: China, Silicon Valley, and the New World Order?

Answer: If you are a business owner or an advisor to business owners I strongly suggest you buy Kai-Fu Lee’s recently published book[1], read it, and carefully reflect on what you read in the contexts of business value, business transition, and how much different our world is likely to be when near- and longer-term AI related changes are virtually certain to occur ‘before our very eyes’.

If Charles Darwin, whose theories I discussed in my last post – see Change, Darwin’s Thesis, and Business Value and Transition – had an opportunity to read this book he just might say “I told you so.”

What is meant by the term artificial intelligence?

Answer: Artificial intelligence (AI) is an umbrella term used to describe the ability of a mechanical device (e.g. a computer or computer-controlled robot) and related programming and systems endowed with the ability to reason, discover meaning, generalize, self-correct, and – importantly in the context of deep learning – learn from past experience.

What is meant by the artificial intelligence term ‘deep learning’?

Answer: Deep learning is a term used to describe the use of computer algorithms to progressively manipulate large amounts of data to generate otherwise unobtainable, useful outputs that can be used to improve both commercial and non-commercial results.

Deep learning through algorithmic activity may prove to be the greatest business game changer of all – and hence to business-specific prospective value and in business-specific transition contexts.

Who is Kai-Fu Lee, and what does he know about artificial intelligence?

Answer: Dr. Kai-Fu Lee is the chairman and CEO of Sinovation Ventures[2], a China-based venture capital firm. Educated in the United States, prior to founding Sinovation Ventures he was President of Google China having previously held U.S. executive positions with Apple, SGI and Microsoft. Lee is said to be:

- one of the world’s most respected experts on Artificial Intelligence and on China.

- an oracle when it comes to predicting the future of technology in China.

A former Apple CEO likens Lee’s explanation of the ‘new AI world order’ to Steve Jobs early explanation of how personal computing would fundamentally change humanity.

See Dr. Kai-Fu Lee interviewed on CBS’s 60 Minutes earlier this year.

In 149 words, why should I read AI Super-Powers?

Refined Answer: Among many other things, Lee explains in his book why he believes:

- AI will advance quickly and exponentially.

- AI will create U.S. and China dominance, where the U.S. and China are culturally different.

- AI will result in job losses and in growing inequality both between and within countries.

- AI, in particular ‘deep learning’, will revolutionize dozens of industries. Business owners and their advisors need to read Lee’s book, and then interpolate what AI is likely to mean – both directly and indirectly – to their businesses, those of their clients, and to business value and transition options.

- Chinese government officials, entrepreneurs, and investors are “ramping up AI investment, research, and entrepreneurship on a historic scale”.

- Recent, powerful developments tip the balance of AI power in China’s direction.

Crass Answer: If you have to ask you probably shouldn’t. Instead, have fun until you don’t.

One Minute Survey

[1] Available at Amazon, Apple, and likely at your favorite bookstore.

[2] From the Sinovation Ventures website – August 2019: Sinovation Ventures is an established Chinese technology-savvy investment firm, started in 2009 by a team led by Dr. Kai-Fu Lee, with presence in Beijing, Shanghai, Shenzhen, Seattle and Silicon Valley. We currently manage an over $2B AUM between seven USD and RMB funds in total, and over 300 portfolio companies across the technology spectrum in China and the U.S. We are one of the first Chinese ventures firms establishing a presence and investment practice in the U.S.

Tags: advisor to business owners, AI, AI entrepreneurship, AI investment, AI learning, AI pwer, Apple, Artificial Intelligence, Business Owner, business transition, Business Value, business-specific transition, business-specific valuation, China, deep learning, Kai-Fu Lee, Microsoft, robot, Silicon Graphics Inc., Silicon Valley, Technological Advances, Technology, United States

by Ian R. Campbell | August 7, 2019 | Economy

Articles, books, and presentations periodically come to our attention we think business owners and their advisors ought to find valuable. This presentation is one of those. Review time is estimated to be about 20 minutes. Thinking time may be much longer.

Question: Who is James Bullard, and what did he say yesterday?

Answer: James Bullard is the President and CEO of the Federal Reserve Bank of St. Louis, one of the twelve independent U.S. Regional Reserve Banks These are intended to ensure that when making U.S. national monetary policy economic conditions throughout the United States are considered.

Yesterday, August 6, Mr. Bullard addressed the National Economists Club in Washington, D.C. His presentation is titled A Sea Change in U.S. Monetary Policy. It is short and to the point. I believe business owners, their advisors, politicians, and anyone else interested in the global and country-specific economies ought to read and think about its contents.

Question: What topics does Mr. Bullard address that influence monetary policy?

Answer: Topics addressed (in alphabetic order) include:

- Federal (Reserve) Open Market Committee (FOMC) policy.

- Global trade negotiations and uncertainties.

- Recent changes to U.S. treasury bill rates.

- The yield curve.

- U.S. economic growth.

- U.S. inflation.

- U.S. real GDP 2018 and prospective growth rate.

One Minute Survey

Tags: Economic Growth, Federal Reserve Bank of St. Louis, financial markets, global trade uncertainties, global trading, Inflation, Interest Rates, James Bullard, trade disputes, trade policy, U.S. Economy, U.S. monetary policy, yield curve

by Ian R. Campbell | May 3, 2019 | Business Value and Transition

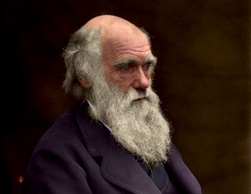

Why is a picture of Charles Darwin[1] relevant to a discussion of business value and transition?

Answer: Based on 50 years of business value and transition consulting experience I believe:

- we live in a watershed economic, business, and business value and transition environment.

- today, as never before, Charles Darwin’s thesis of natural selection needs to be understood and considered by every business owner.

What is Charles Darwin’s thesis of natural selection?

Initially, Darwin did not use the term Survival of the fittest. Instead, British economist Herbert Spencer used that phrase after reading Darwin’s 1859 book On the Origin of Species. It caught on, and Darwin used the term in a subsequent edition of his book.

Survival of the fittest is an umbrella phrase that masks and leads many to misinterpret Darwin’s messaging. If one takes the time to read and consider other quotes attributed to Darwin[2] it becomes clear that a high level Darwin’s thesis can be stated to be:

‘those who implement change to their advantage more quickly than others are those who, through collaboration, best identify and adapt to change.’

Is ongoing economic and business change impacting business value and transition?

The answer must be ‘yes’ given the smorgasbord of ongoing inter-related economic and business-related segment changes that include:

- Globallization.

- Potential de-globalization if President Trump has his way.

- Central bank policies – particularly after 2008.

- Developed and developing country government debt, government intervention, government policies, and government intervention.

- Technological advances.

- Business consolidation.

- Financial markets heavily influenced by algorithmic trading.

- Climate change.

- World population growth and societal disruption.

- Incomplete, sensationalized, and in some cases what appears to be poorly researched news.

These and other things will continue to impact both the value and transition of most if not all large and small publicly and privately-owned businesses to varying positive and negative degrees.

Concerning that melded ongoing change:

- Some of these changes and related changes are more predictable than others.

- The pace of change is likely to escalate in some of the cited segments.

- All businesses will be influenced in varying degrees and for better or worse by ongoing changes.

- For some companies these changes collectively may lead to business value enhancement, for others business value deterioration – and hence to greater or less business transition success.

How does Darwin’s thesis play into a discussion of business value and transition?

Business value growth and in turn successful business transition are both influenced – I believe in an ever-escalating way – by the degree to which business owners accept and act upon Darwin’s thesis.

It is crucial that all business owners hear this messaging, and that each decide whether they agree it makes sense. Moreover, this messaging is particularly important for owners of family businesses. That is because there is a greater proclivity for family business owners to compromise from arm’s length principles where their emotional intelligence plays too large a part in their business decision making.

I believe that all business owners should consider Darwin’s thesis and apply it to their specific circumstances. Private company business owners, irrespective of whether the business is family-owned, need to consider their ability to adapt quickly to changing business conditions and prospects having regard to their collective capabilities and the current and prospective financial position of their company.

Private company business owners should consider now – and on an ongoing basis as they experience continuing change in our increasingly competitive business environment:

- whether developments and advances outside their control are impacting the near- and long-term risks and going-concern viability of their business.

- whether the long-term going-concern viability of their business is at risk as a result of its current financial position, growth prospects, and competitive prospects going forward.

- whether the size and prospective size of their business are such that it will be able to compete effectively in the near- and long-term. This where larger companies in many cases seem increasingly likely to be favored in the contexts of – among other things – both supply and demand chain metrics as a result of ongoing globalization and technology advances and the costs and cost savings related to both of those things.

- whether as a result of conclusions reached in respect of business viability and likely future competitiveness, whether their business should be offered for sale now, or be prepared for sale at some point in the next, say, two – five years.

- whether current employees need to be replaced with persons better equipped to face current and prospective competitive challenges.

- whether ongoing technological advances may have a material favorable or adverse effect on their business in the contexts of both required future capital investment, and the timing of that investment.

Finally, in family businesses, it is becoming ever more critical to consider whether employed family members should retain their current positions, or should assume jobs that better suit their skill sets. Any family business owner that objectively makes such assessments and acts on them will bring a smile to Charles Darwin’s face, wherever he now is.

[1] Charles Darwin’s (1809 – 1882) book On the Origin of Species by Means of Natural Selection, or the Preservation of Favoured Races in the Struggle for Life was first published in 1859.

[2] For example, Darwin is quoted as saying: “It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one most adaptable to change, that lives within the means available and works co-operatively against common threats.” ”The world will not be inherited by the strongest, it will be inherited by those most able to change.” “It is not the biggest, the brightest or the best that will survive, but those who adapt the quickest.” “In the long history of humankind (and animal kind, too) those who learned to collaborate and improvise most effectively have prevailed.”

Tags: advisors, board of directors, business, business consolidation, Business Owner, business owners, business transition, Business Value, business value and transition, business value growth, central bank pollicies, Charles Darwin, Climate Change, companies, company, Darwin’s thesis, de-globalization, Family Business, family business owners, financial markets, Globalization, going concern viability, Government Debt, government intervention, government policies, government regulation, natural selection, ownership transition, population growth, privately-owned, publicly-traded, Recession, Regulation, societal disruption, survival of the fittest, Technological Advances

by Ian R. Campbell | April 23, 2019 | Corporate Governance

How Necessary is Good Corporate Governance to Business Value Growth and Business Transition Success?

Answer: Very necessary! It is not a stretch to suggest that for privately-held companies it is a fair generalization to suggest that business value growth and business transition success on the one hand, and corporate governance on the other, are interdependent. Further, at any given point in time assessing the veracity of a company’s corporate governance is fundamental to developing either its notional value or negotiating an open market price for all of its outstanding shares.

Commentary: We live in a business and social environment evermore influenced by continual transitioning globalization factors, central bank policies, government-related business and societal uncertainties, ongoing technological advances, and ongoing business combinations activity. It follows that Implementation and ongoing compliance with superior corporate governance practices are increasingly important to promote ongoing viability, value growth and successful ownership transition in individual private companies. See related blog posts Business Transition – General: The Right Overview Question and Recession Impact by Industry and Business is a ‘Right Question’! .

Why a Chrysalis -> Butterfly image?

Question: Why a chrysalis -> butterfly image as a lead-in to a discussion of corporate governance?

Answer: We live today in a world of continual transition on many important fronts. If the butterfly does not react to climate change and hence does not successfully transition from its chrysalis state, it will not survive. Parallels in this regard between the butterfly and a privately-owned company are very easy to identify.

What is Corporate Governance?

Answer: Corporate governance is a term used to describe the system of mechanisms and processes by which a business is controlled and directed. Broadly, a corporate governance system:

- details the rights and responsibilities of the board of directors, members of an advisory board if one exists, owners, executives, managers, and other employees.

- establishes and continually adjusts the rules, practices, and processes:

- that influence and appropriately align and balance the mutual and individual interests of all stakeholders.

- for making business decisions.

- that collectively coordinate and monitor the company’s objectives through strategic plans, business plans and forecasts, and the like.

- Ensures all of those things are complied with on an ongoing basis through a continuous monitoring process.

Corporate Governance Initiatives. Which Should Private Company Owners Prioritize?

Answer: If corporate governance excellence is absent in their company, business owners should:

- consider engaging an independent, objective consultant with experience in their industry to conduct a detailed Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis of their business.

- based on that SWOT analysis, decide whether the business:

- is likely to be viable as a going concern In the long-term, or

- should be organized for sale to an arm’s length purchaser.

- if the business is assessed as likely to be viable as a going concern in the long-term:

- identify recently retired (preferably same-industry) executives or other qualified people and invite them to join the company’s board of directors.

- alternately, establish an advisory board of such arm’s length people if candidates are not willing to accept the fiduciary responsibilities director’s shoulder – or if an advisory board is a preferred course.

- If a family business, elect a non-family member as Chairperson of the Board or Advisory Committee as the case may be.

- make that Chairperson responsible for developing, implementing, and thereafter monitoring, a sound corporate governance system for your company going forward.

Important Corporate Governance Comment

There are advisors, be they directors, business advisors or professional advisors – and then there are advisors. A business owner should only engage advisors where mutual respect and trust exists, and where the advisors ‘speak truth to power’ – and are listened to and not resented for doing that. I am particularly emphatic on these things in the case of family business owners who employ family members.

Tags: advisors, advisory board, board of directors, business combinations, Business Value, business value growth, Central Bank Policies, chairperson, Corporate Governance, directors, Family Business, Globalization, Notional Value, Open Market Price, ownership transition, professional advisors, Recession, retired executives, SWOT analysis, Technological Advances, truth to power

by Ian R. Campbell | April 16, 2019 | Generational Transition

Note: The term Estate Freeze is broadly used in Canada by business advisors and owners. Other jurisdictions may be subject to different laws, terms and practices. Readers should discuss the contents of this post with their professional advisors.

Why an Iceberg image?

Question: Why an iceberg as a lead-in to an estate freeze discussion?

Answer: Approximately 90% of an iceberg is a submerged, hidden danger. An estate freeze is a related series of transactions in issued private company shares that likewise often is not all it seems to be.

An Estate Freeze – Be Surprised – Ask Professional Advisors Two Questions

Question: Would professional advisors themselves act on their estate freeze advice?

Commentary: Discussion over many years suggests that if one ask a room full of professional advisors:

- if they would like to be in business with their brothers and sisters. Less than 10% are likely to answer in the affirmative.

- how many of them have advised their family business clients to complete an estate freeze principally to defer income tax. More than 90% are likely to answer in the affirmative.

It follows that many of those advisors have:

- effectively created partnerships for their client’s next generation that they may not have created for themselves.

- typically done that without concurrently working with their client to develop a comprehensive family business transition plan – or as a minimum recommending that be done.

Estate Freeze Defined

Question: What is meant in Canada by the term estate freeze?

Answer and Commentary: In a family business context, estate freeze is a term to describe a transaction that results in one generation of family business shareholders ‘freezing’ the value of their respective share interests at an amount equal to a notionally determined fair market value at a specific point in time.

The principal objectives of an estate freeze are to:

- pass growth in capital (i.e., family company share) value, typically at nominal cost, on to one or more subsequent generations.

- minimize what otherwise would be a larger income tax on a disposition or deemed disposition at the time of the death of shareholder-members of the current generation.

Typically, this is done in income tax jurisdictions that allow it by:

- having the current owners:

- exchange their common shares for fixed value preferred shares in the family business.

- file prescribed income tax forms necessary to complete the estate freeze

- issuing treasury (new) common shares to subsequent family generation members at a nominal cost.

Estate Freeze Discussed

The Important Question: Is an estate freeze implemented in isolation a comprehensive generational business transition?

Answer and commentary: The simple answer is no. A more complete answer follows.

In some jurisdictions an estate freeze can:

- potentially result in significant income tax deferral.

- result in family members thinking they have completed a comprehensive family business transition plan, which they have not.

- result in the pre-freeze common shareholders imposing a family partnership on subsequent generation family members without the latter individually or collectively:

- understanding the possible business and personal potential consequences of that – both good and bad.

- seeking independent legal advice.

- paying only a nominal amount for capital assets (i.e., company shares) that are expected to increase in value, where this may contribute to next generation:

- business partners who aren’t interested in the family business other than for the lifestyle it provides them.

- business partners not equipped to effectively participate in the family business as directors, executives or employees.

- entitled attitudes, unrealistic value systems, and unrealistic monetary expectations.

Further, estate freezes:

- frequently are completed without concurrent execution of a well-documented shareholder agreement.

- may lead to acrimonious family relationships and at extremes litigation.

An Estate Freeze – Conclusions

An estate freeze:

- can prove to be an effective way for business owners to manage income taxes.

- may solve short-term problems while concurrently laying the foundation for substantive long-term issues.

can be a useful monetary tool if all stakeholders understand its principal purpose and use it as a catalyst in the development of a comprehensive family business transition plan.

Tags: business owners, business partners, business succession, business successionplan, business transition, businesstransitionplan, common shares, estate freeze, Family Business, family member, income tax deferral, preferred shares, professional advisors, Shareholder Agreement

RSS - Posts

RSS - Posts